Why Landlords Are Being Unfairly Blamed — And What You Can Do About It

You’ve likely seen recent headlines highlighting tenant frustration over proposed rent increases, some as high as 7%. Unfortunately, what’s missing from those headlines is the real story behind those numbers, according to James Dibbini of James G. Dibbini & Associates, PC. The truth is, New Yor

How Leaders Can Support Their Employees In Times Of Crisis Or Disaster

Building a family-oriented work culture is essential for any business. When team members are treated like family and genuinely support one another, they create a strong, collaborative environment. This bond becomes especially valuable during challenging times, ensuring that help and support are alw

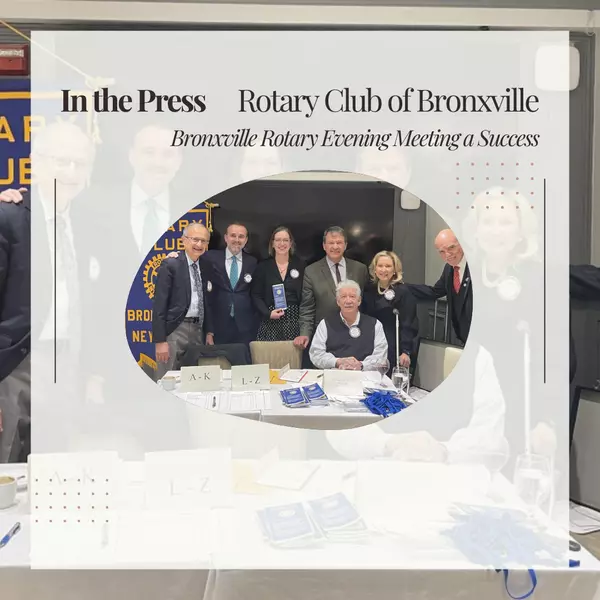

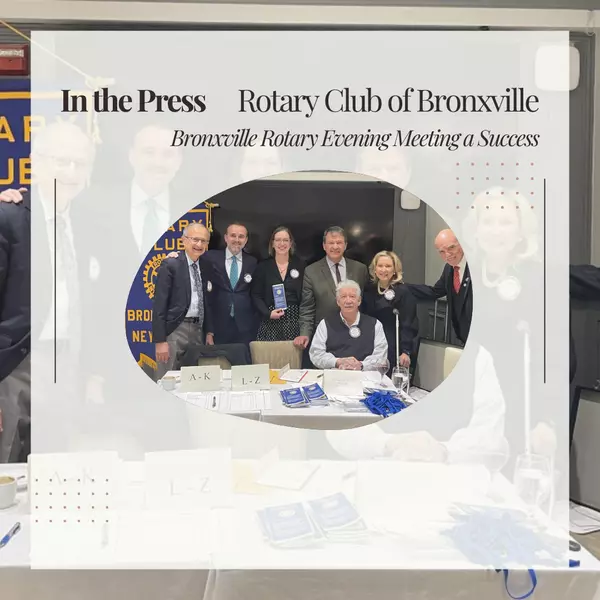

Rotary Club of Bronxville - Bronxville Rotary Evening Meeting a Success

On February 20, 2025, a special evening meeting with special guest speaker, Congressman George Latimer, was a success on all fronts. Dinner at Ciao's in Tuckahoe was plentiful and delicious. Read Entire Article in Rotary Club of Bronxville

Categories

Recent Posts